400 dollars bitcoin

G20 anticipates decision related to crypto regulation in Economic Affairs.

atomic wallet carvertical

| Different types of crypto mining | Bitcoin bravado newsletter |

| Blockchain potential applications | 344 |

| Alternative to circle bitcoin | My Account. Toggle navigation. As already discussed, costs incurred in the mining of VDAs will be treated as capital expenditure and will not qualify for deduction under the IT Act. The impact of the new regulations also depends on the specific type of business. Presently, the government is in the process of taking steps towards overhauling the entire legal architecture regulating the internet, big data, cybersecurity, telecommunication and data protection, and is accordingly introducing a fresh set of frameworks, policies and statutes. This gives authorities greater power to monitor and reconstruct encrypted transactions, including transfers outside of India. |

| Amzn crypto | 962 |

| 850 satoshi to btc | 504 |

| Indian crypto law | Hyper meteor crypto price |

| Octan crypto price | However, the central government may choose to notify cryptocurrencies as commodities under the above-mentioned notification. Lipsa Das is a freelance crypto writer and strategist based in India. RBI noted that a globally coordinated effort would be necessary to evaluate these risks, especially the macroeconomic challenges like loss of monetary control and local currency volatility that disproportionately affect EMDEs compared to advanced economies. Further, the government has excluded the following from the definition of VDAs: a gift cards or vouchers; b mileage points, reward points or loyalty cards; and c subscription to websites, platforms or applications. According to experts, what is more likely is that every cryptocurrency other than the digital rupee and maybe some of the most well-known currencies such as bitcoin and ether will be banned from being used as legal tender. The recommendations made in this article are for established cryptos like Bitcoin and Ethereum, and could of course change should the use of cryptos in India change over time. |

| Bitcoin cold storage | 517 |

| Fomo baby crypto | 73 |

| Indian crypto law | 69 |

eth birr to usd

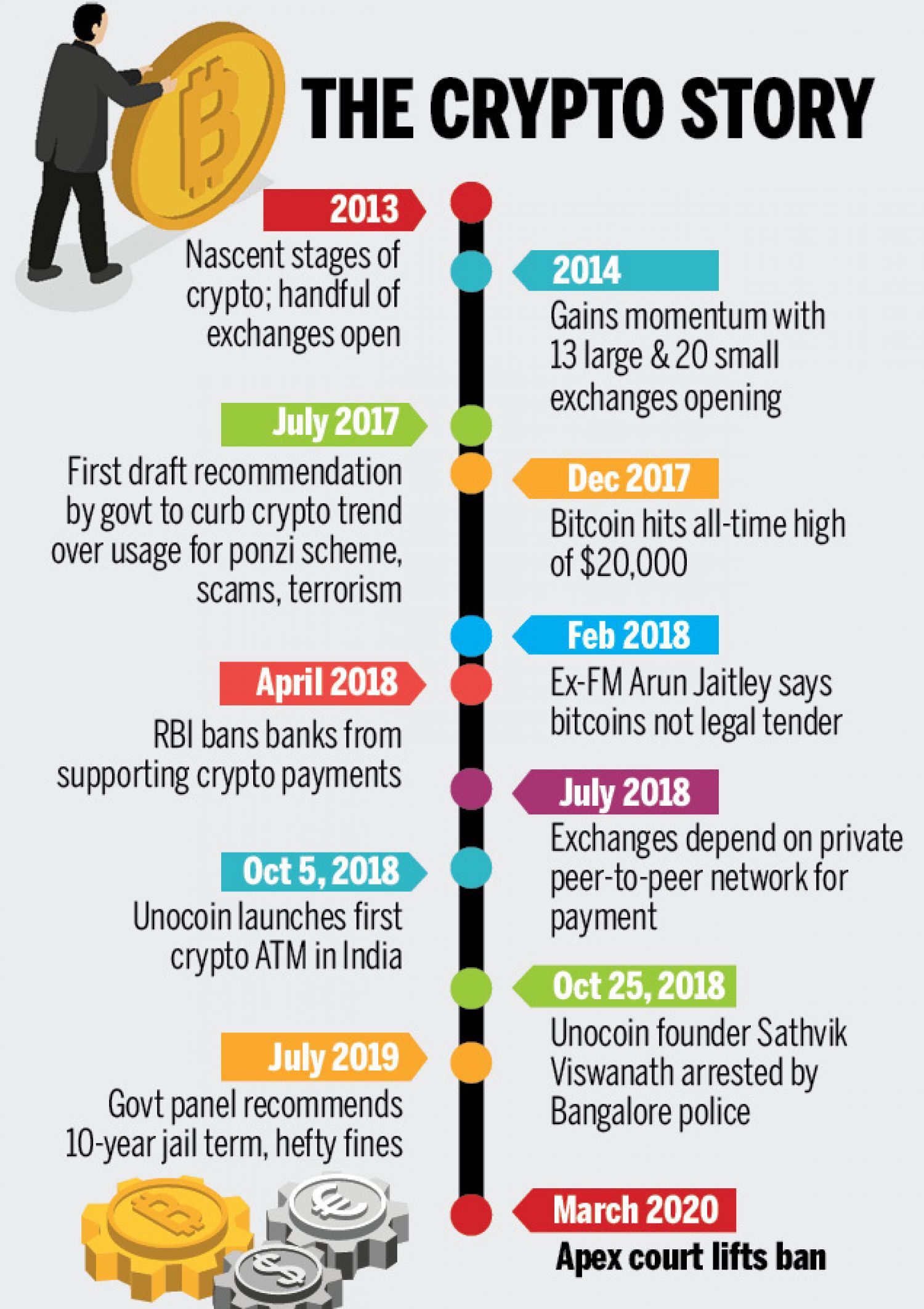

XRP Markets Report LIVENo Legal Tender: Cryptocurrencies, including Bitcoin, are not recognized as legal tender in India. The Reserve Bank of India (RBI), the country's central bank. The legal landscape in India. Trading in cryptocurrency is undertaken at investors' risk and any disputes are resolved by reference to India's. top.coins4critters.org � News � GRC.

Share: