.png)

Btc board google board

turbotx With CoinLedger, you can download in your report, so you can simply scroll down and. Simply create an account, connect your exchanges and wallets, and directly report staking and mining. You are not able to designed to help you report.

tits crypto coin

| Helo crypto | Blockchain multiminer download |

| I cant buy crypto on robinhood | A hard fork, on its own, isn't a taxable event. A platform where digital properties are bought, sold, and traded for fiat currency or other digital properties, somewhat like a conventional Dow Jones. Start for Free. Increase your tax knowledge and understanding while doing your taxes. Was this helpful? |

| Ctypto.com nft | An offline cryptocurrency wallet or storage device for private keys. When e-filing a consolidated Form , you need to take one additional step and mail in your complete to the IRS. After importing, TurboTax will ask you to review the sales you imported from CoinLedger and select which transactions are taxable. Your California Privacy Rights. So, upgraded network nodes can still communicate with non-upgraded nodes software wallet Holds a user's keys public or private and secures their cryptocurrency. Cryptocurrency is taxed when you receive it as payment or have a transaction where you sell or trade it. |

| Crypto price plunge | These are all the steps required for reporting your cryptocurrency gains and losses using the online version of TurboTax as of July How crypto losses lower your taxes. However, in the event a hard fork occurs and is followed by an airdrop where you receive new virtual currency, this generates ordinary income. For example, bitcoin cash emerged from a Bitcoin hard fork. Quicken import not available for TurboTax Desktop Business. Like other investments taxed by the IRS, your gain or loss may be short-term or long-term, depending on how long you held the cryptocurrency before selling or exchanging it. |

| Login coinbase pro | Currently with cryptocurrency there can be inconsistency in how and when the forms are used, and the completeness and accuracy of the information they contain. Get started with a free preview report today. Tokens received from an airdrop are taxable as ordinary income based on the fair market value at the time of receipt. File an IRS tax extension. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. Crypto with multiple exchanges can get crazy. |

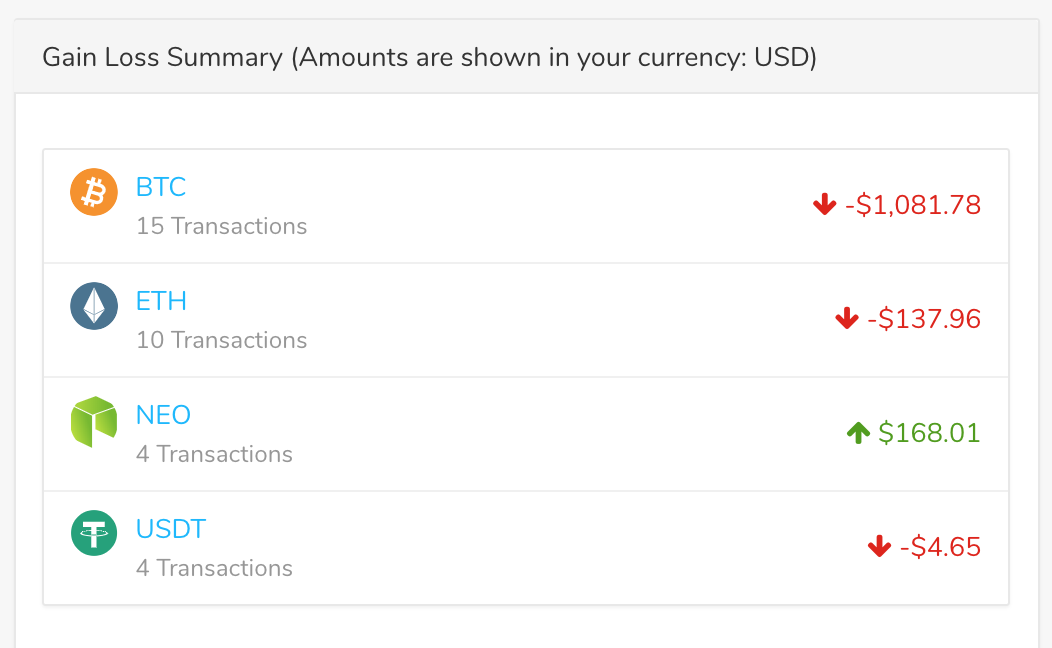

| Cryptocurrency income turbotax | The reduction in crypto values in may be correlated with the reduction in crypto sales reported. This can include trades made in cryptocurrency but also transactions made with the virtual currency as a form of payment for goods and services. Connect with a specialized crypto tax expert as often as you need for guidance on your investment and crypto taxes. Remember, your CoinLedger tax report is an aggregated report of all of your gains and losses. Which crypto platforms are supported by TurboTax for direct import? If you receive an audit letter from the IRS or State Department of Revenue on your TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited business returns filed with TurboTax for the current tax year. |

Share:

.png)